15 Best Free Apps To Save Money Everybody Should Have

If you want to make job replacing income and want to work online from the comfort of your home or anywhere in the world

Take a look at this - Live Chat Jobs

Your smartphone is essential to your day-to-day routines. Luckily using some of the apps on your smartphone, there are many ways people can save their money each year. Check out these five apps that will help you reduce your bills and save a little money every month.

If you’re looking to save money, these are some of the best apps to use. It’s convenient and very easy to use these apps on your phone to help your budget and save money throughout the year. Using a smartphone can help you use technology to your advantage to start saving money today. These apps will help you save money and will save you hassle with bills each month.

Here are the Best Free Apps To Save Money

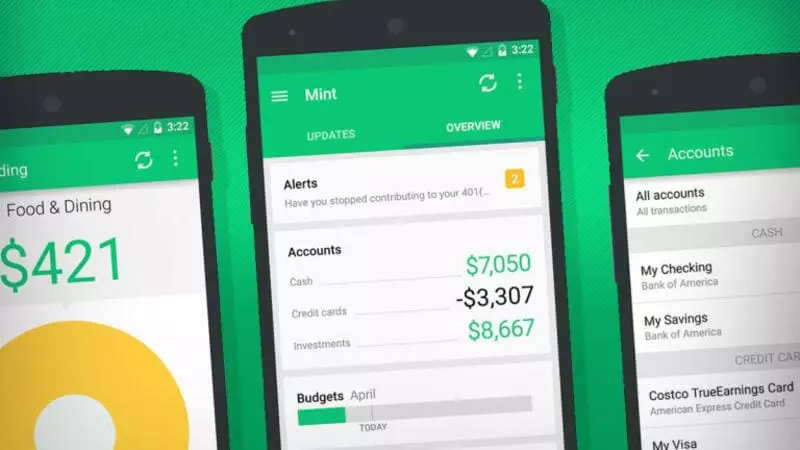

1. Mint

Mint is a free money management app that allows you to keep track of your spending, budget, and budget goals. The app allows you to view all your transactions. It also keeps track of your cash flow, savings, and helps you manage your finances.

Mint is a free app available for iOS and Android users.

2. Trim

Trim is one of the best apps to use if you want an affordable budget. Trim automatically analyzes your spending and finds areas where you can cut back and save. The app also analyzes your spending history to deliver customized recommendations that suit your spending habits.

Trim helped people save $1,000 in two months. It also offers discounts on everything from groceries to gas. Trim is available for free on both platforms iOS and Android.

Also Read: 25 Best Money Making Apps For Quick Money

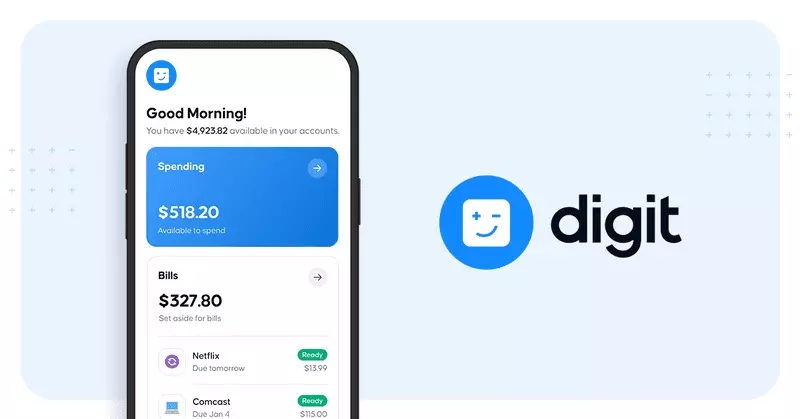

3. Digit

Digit is a free debt payoff app that analyzes your phone’s bill history and makes recommendations based on how much money you can save. With Digit, you’ll automatically be charged a small fee each week to transfer money to your Digit account, and this app uses that fee to pay off your bill.

You can also set your own weekly budget, and Digit will transfer the money from your Digit account to your checking account whenever you’ve reached your budget amount.

Digit is available across iOS and Android.

4. Clarity Money

This app is designed to help you save more money by helping you identify areas of your financial life where you could save money. Once you identify those areas, you can set goals, track your spending, and share your progress with others.

The app sends you alert notifications about certain spending patterns, and it can even recommend a budget that is better for you. You can even earn rewards when you reach certain savings goals.

Clarity Money is available across iOS and Android.

5. Stash

This app can help you keep track of all of your monthly bills and recurring expenses. This app allows you to track your current spending, set financial goals, and even determine how much your spending has fluctuated over time.

You can invest your money through Stash using a mobile app or a website. Stash uses index funds and ETFs for investing, and they help you set a budget that you can use for investing. You can track your investments in one place, and you can change your investment goals whenever you like. Stash even helps you manage your investments for children and for retirement plans.

Stash is available on iOS and Android.

6. ibotta

Ibotta is a free app that lets you earn cashback every time you go to the grocery store. Ibotta works with over 4,000+ grocery stores and restaurants, including Walmart, Target, Costco, CVS, Publix, and other major brands.

When you shop using the Ibotta app, you can earn up to $5 back on every $20 you spend. Ibotta even works with stores like HEB, Trader Joe’s, Aldi, and Costco. Ibotta even works with some online retailers like Amazon and Newegg.

Once you’ve made a purchase, Ibotta will deposit your money into your Ibotta account within 24 hours. Then, all you have to do is redeem the money you got back from Ibotta to your PayPal account or Payoneer.

Ibotta can be downloaded for free and is available to use on both iOS and Android devices.

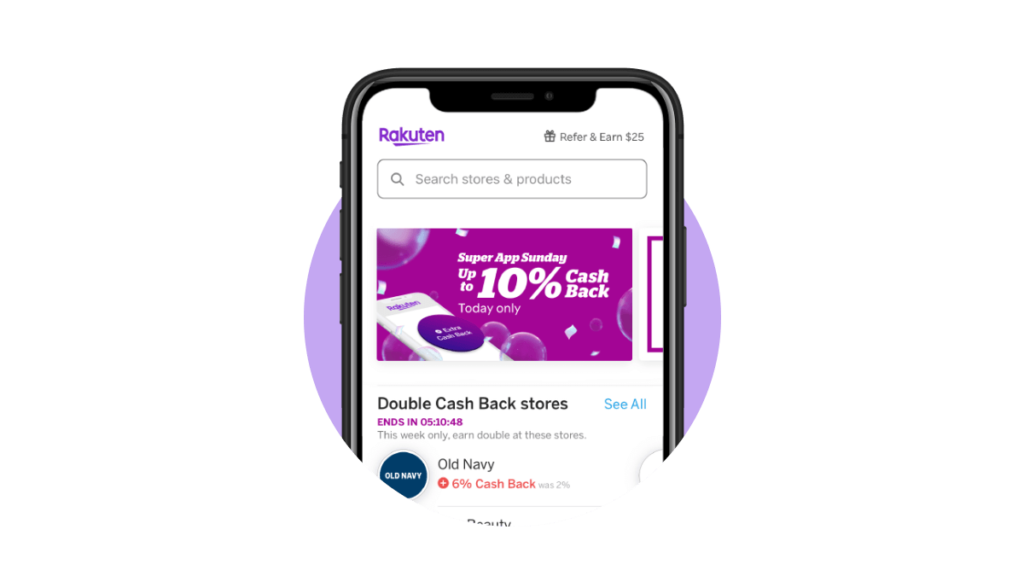

7. Rakuten

Formerly Ebates, Rakuten is a leading online shopping website. Just like Ibotta, Rakuten lets you earn cashback in the form of PayPal cash when you make your purchases at participating stores. To redeem your cashback, simply visit Rakuten’s website and log in by using your Ebates account.

Rakuten has already helped people save over $1 billion in more than three years. You can get cashback from shopping at eBay, Walmart, Target, Best Buy, Macy’s, and more stores.

Rakuten is available for both iOS and Android users.

8. Qapital

Qapital is similar to Digit in that it uses your phone’s bill history to help you pay off your debt. Qapital also analyzes your spending patterns and delivers personalized savings and budget suggestions.

This app sets aside three percent from each purchase you make and transfers it into your savings. Qapital automatically rounds up your purchase to the nearest dollar and transfers the spare change into your savings. The spare change adds up to $100+ per year. Like the other money-saving apps on this list, Qapital also works with retailers like Walmart, Target, and Amazon.

Qapital is completely free to use and you can sign up for an account on iOS and Android devices.

9. Truebill

Truebill is another app that helps you save money on your monthly bills. Truebill automatically tracks all of your bill payments, including rent, utilities, insurance, and subscriptions. The app uses this information to help you manage your bills and cut down your monthly expenses.

Truebill also identifies areas where you can save more money each month. The app also encourages you to shop around for lower-priced services.

Truebill is free, and it’s available for both iOS and Android users.

10. Halfdollar

Half Dollar is for folks who haven’t gotten into the habit of regularly saving. The app connects to your bank account and analyzes your spending habits. Halfdollar then matches you with an amount that you can automatically save each month.

You earn points for each dollar you save, and these points can be redeemed for gift cards and other rewards. You can also set a budget that you’re comfortable with. Every penny you earn is deposited into your savings account, and you can start growing your wealth right away.

The app requires a one-time installation, but it won’t cost you anything to download it. This is available on iOS and Android.

Also Read: Top 25 Apps That Pay You to Walk

11. Budgt

Budgt is a free budgeting app that has been downloaded over a million times. The app connects to your bank account and associates your spending and saving with categories like groceries, dining out, and entertainment.

Budgt’s tracking feature allows you to monitor your spending in real-time, and it also offers tips on how to save money. Budgt even lets you earn rewards for saving money each month.

Budgt is a free app available to use on both iOS and Android devices.

12. You Need a Budget (YNAB)

YNAB is one of the best budgeting apps on the market. The app is free to download, and it allows you to monitor your budget and lifestyle. YNAB is also available as a desktop program, and you can use its budgeting feature on your computer.

YNAB will help you set financial goals, and it will also give you daily spending and saving updates. YNAB costs $40 per year, but the app’s budgeting feature is available to users with a free account.

13. RoundUp

This app allows you to round up your debit purchases to the nearest dollar and transfer the difference to your checking account. For example, if you had a $30.50 gift card, you can now spend $31.00 and RoundUp will transfer the remaining 50 cents to your checking account.

RoundUp is a free service you can use on both iOS and Android devices.

14. PocketGuard

PocketGuard is a budgeting app that allows you to set goals and monitor your spending in real-time. Once you connect your bank account, Pocket Guard will give you shopping notifications every time you make a purchase above your budget.

PocketGuard can be downloaded on both iOS and Android devices.

15. Acorns

Acorn is a saving app that rounds up all of your purchases and invests the change into your future. The app is free to use and available for iOS and Android users.

Using this app is an easy way to save without really thinking about it. You can connect all of your bank accounts and credit cards to Acorns, and the software will automatically invest the change into the stock market.

Acorns is a free app available for iOS and Android users.

Conclusion

There are numerous apps that you can use to save money. Some of the apps above are easy to use and have minimal to no learning curve. You can manage your finances on your smartphone, tablet, or laptop.

Whichever app you choose to use, keep in mind that these apps are not meant to be used as the sole way you manage your money. You need to compete in life, and these apps can help you manage your money more efficiently, but they can’t make you better at saving money.

To improve your financial health, you need to become financially literate and learn how to manage your money.

If you have any further questions about any of the apps listed above, please let us know in the comments section below!